热点栏目

热点栏目来源:市川新田三丁目

译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

Dollar Crash: Reasons And Consequences

by Michael A. Gayed

Summary

概要

The dollar is currently the world’s reserve currency.As of Q1 2020,almost 62% of global exchange reserves were held in dollars.

美元当前人士全球最主要的储备货币,截止到2020年一季度末,全球约62%的外汇储备为美元标价的资产

However, trade tensions and geopolitical concerns

have the potential to trigger a global de-dollarization movement.

但是,贸易争端和地缘政治方面的担忧有可能引爆全球范围内的去美元化浪潮

The Fed’s loose monetary policy too is not helping the average Joe,and it could end up hurting thedollar’s value.

美联储的宽松货币政策对美国普罗大众没啥助益,并有可能最终利空美元汇率的走势

A U.S. dollar is an IOU from the Federal Reserve Bank. It‘s a promissory note that doesn’t actually promise anything. It‘s not backed by gold or silver.−P. J. O’Rourke

美元是美联储开出来的一张欠条,是一张实际上根本无法兑现的空头支票,没有以黄金或者白银作为信用保障−美国政治讽刺家和专栏作者P. J.O‘Rourke

The U.S. dollar is currently the world’s leading currency. As per the IMF,61.99% of global exchange reserveswere held in dollars as of Q1 2020. Most businesses across nations use the dollar in international transactions, followed by the euro and the Japanese yen. It‘s estimated that about40% of the world’s debtis issued in U.S.dollars.

当前美元仍是全球最主要的储备货币,根据国际货币基金组织的数据,截止到2020年一季度末,全球有61.99%的外汇储备体现为美元标价的资产。各国企业在国际贸易和跨国经营中使用最多的货币就是美元,其次是欧元和日元。据统计,有约40%的全球债务以美元标价。

Image Source:IMF data

The dollar had derived its strength from thestrong U.S. economy, but the arrival of COVID-19 has changed the rules of the game. There’s a lot of speculation these days that the dollar will crash and lose its prominence as the global reserve currency.Such doomsday theories may or may not prove right, but this is the right time to discuss a worst-case scenario:

美元的主导地位来自于美国经济的强势,但是新冠疫情的突如其来改变了一切。一段时间以来有很多人在猜测美元的币值会塌陷并失去其作为全球最主要储备货币的地位。此类“末日将近”般的言论或真或假,但是现在确实到了应该讨论一下美元所可能遭受到的最坏情景的时候了。

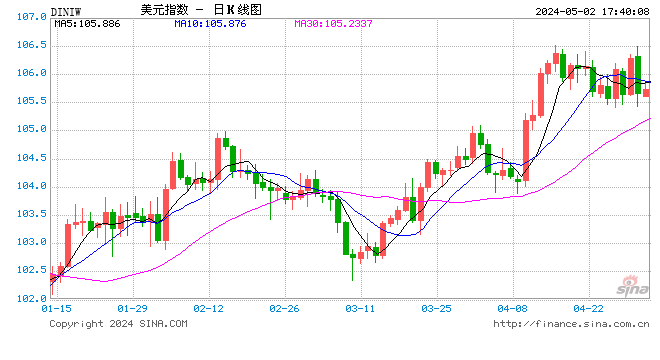

Current Strength of the Dollar

当前美元的强势

Image Source:Investing.com

Since April 19, 2020, the Dollar Index Futures (DXY) and theUSDEURhave fallen by 10.05% and 9.38%,respectively. This significant weakness in the dollar in the recent past is a red alert.

自2020年4月19日以来,美元指数(美元指数的代码为DXY)期货合约的报价以及美元/欧元的汇率分别下跌了10.05%和9.38%,近期美元汇率的大幅贬值可不是好兆头。

Another important indicator is the 10-Year Treasury Notes. As we know, the interest rate on these securities is currently just about 0.63%, and the Fed already has announced that it will hold such low levels of rates until 2022. The real rate of return thus turns out to be still lower – in fact, negative after accounting for inflation. So, it‘s uncertain how long global investors will keep investingin these bonds. If the fund flows reduce, the dollar value will be adversely impacted.

另一个值得重视的指标就是10年期美国国债的收益率水平。我们知道,当前10年期美国国债的收益率约为0.63%,美联储已经宣布将在2022年以前继续将利率水平保持在如此之低的位置上。因此,美国国债的实际收益率仍相当低,如果考虑到通货膨胀的因素实际上处于负值区间。因此,全球各国的投资者买入美国国债的兴趣能维持多久还需要画一个问号。如果流入美国的外部资金流出现减少,会对美元的币值构成利空。

Factors that Could Cause a Dollar Collapse

有可能导致美元汇率大幅贬值的因素是什么?

1.De-Dollarization

去美元化

Recent geopolitical tensions have kept the currency pot boiling beyond tolerable limits. On Aug. 5, 2020,Russia and China announcedthat they would enter into a financial alliance to reduce their dollar dependence. In Q1 2020, the dollar’s share in these countries’ trade declined to below 50% for the first time. The Euro’s and their national currencies’ share climbed to 30% and 24%,respectively.

近来,地缘政治方面的紧张局势升温导致有些国家对美元的容忍度出现。2020年8月5日,中俄对外宣布两国将在金融领域加强合作共同降低对美元的依赖。2020年一季度,美元在中俄两国之间贸易结算量中的占比首次跌破50%,欧元和中俄各自货币的占比分别攀升至30%和24%。

If the U.S. government continues imposing trade sanctions on other countries as it has done on China, they too may enroll in this de-dollarization movement. We are not sure if it will happen, but if it does, it will be bad news for the dollar.

如果美国继续对他国实施像对中国一样的贸易制裁,其他国家也会加入去美元化的队伍。虽然拿不准这是否会成为一种趋势,但如果成真,对美元来说可不是个好消息。

2.The Whatever-It-Takes Monetary Policy

美国在货币政策方面不遗余力的放水

The Fed is doing, according to those at the Fed, whatever it takes to support the economy through the course of the pandemic. However, bankruptcies and unemployment numbers are rising along with the fiscal deficit.

根据美联储自己的说法,美联储正在做的是竭尽所能让美国经济度过新冠疫情带来的难关,但是在美国财政赤字大幅增长的同时,企业倒闭和失业的案例也在攀升。

TheAssociation for Corporate Growth, a group that lobbies for middle-market businesses, says that 81% of businesses failed to get a loan through the Fed’s Main Street Lending Program.

一家为美国中等企业代言的游说机构——“企业增长协会”透露有81%的中等企业无法通过美联储的大众借款计划拿到贷款。

Inthe housing sector, the government loan market (Freddie, Fannie, and GinnieMaes) and the private non-agency mortgages have been neglected by the Fed. Thisis hurting the housing sector and analysts are expectingdelinquencies to rise.

在房屋市场方面,以房利美、房地美、吉利美为代表的按揭贷款支援美国联邦政府机构以及私营的非机构类按揭贷款提供商没有得到美联储的援手,这对美国住房市场造成了伤害,分析师预期美国按揭贷款的违约率会出现上升。

Corporate bankruptcies are risingand many retail and oil and gas companies already have shut shop. We know that unemployment numbers are rising and will most likely get back to pre-COVID-19 levels by as lateas2022–2023.

美国企业破产数量正在增加,很多零售商和油气开采企业已经被迫关张。我们知道美国的失业人数正在增加,就业状况要想回到新冠危机之前有可能迟至2022-2023年才能实现。

The point here is that the U.S. national debt is inflating, but the impact of the stimulus is not showing on the ground. People are not thriving as they should be. If good money continues to chase bad money (for example, junk bonds and the avoidable ETFs), it‘s not going to help the economy in any way. It will make people chase risky assets. We already are witnessing Main Street suffering atthe cost of Wall Street.

关键之处在于美国国家债务在迅速膨胀,但刺激经济增长的效果却尚未显示出来。普通民众没有过上应该过上的好日子,如果资金继续追逐高风险资产,比如垃圾债和与此相关的交易所交易基金,将不会给实体经济带来任何好处,而只会让投资者对高风险资产趋之若鹜,我们已经看到普通民众的悲惨遭遇也让华尔街付出了高昂的代价。

3.COVID-19

新冠疫情

If the pandemic prolongs and a safe and effective vaccine or drug is not discovered within a reasonable period, our government will have no option but to keep pumping money into the economy. The only difference that may show up is that it could link the new loans to outcomes. But this is in the realm of speculation, and we will cross the bridge when we get to it.

如果疫情迁延日久,安全高效的疫苗或药物无法在近期内被发明出来,美国政府将别无选择只能继续向实体经济中放水。与以往做法唯一区别的地方有可能在于将新发放的贷款与期望得到的结果挂钩,但这仍只是处于猜测阶段,等到了这一步再说。

4.A Bond Sell-Off

美国国债遭遇抛售

Foreign countries, led by China and Japan, own more than$6 trillion of U.S. debt. If they sell, the dollar will come crashing down. But both countries cannot afford to take that chance because they are dependent on U.S. consumers. This is a next-to-impossible scenario, and I just mentioned it here because anything’s possible in current times.

中国和日本为首的外国投资者持有约6万亿美元的美国国债,如果这两国开始抛售,美元汇率会崩溃式下跌。但是中日均不敢冒这个风险因为他们还需要依赖美国的消费者。这么做几乎是不可能,我只是在这里说说而已,因为在当前这个节骨眼上任何事情都有可能发生。

Consequences of a Dollar Collapse

美元一旦丧失主导地位会有什么后果?

If the dollar crashes for any reason, it will throw the world into economic mayhem. Investors who own dollars will dump it and park their funds in other currencies like the Euro, or in precious metals like silver and gold, or commodities.

如果出于不管是什么原因美元汇率遭遇崩盘,将给世界经济带来巨大的扰动。手里拥有美元的投资者会抛售美元,并转而投资其他货币,比如欧元或金银等贵金属以及大宗商品。

The demand for Treasuries will hit rock bottom and there will be general panic inthe investor community. In the long term, interest rates and inflation wouldrise. The import bill will get costlier, while exports will become cheaper. Itwill hurt us because we are net importers. For example, in June 2020, weimported goods and services worth $209 billionand exported goods and services worth $158 billion, leaving us with a trade deficit of about $50 billion.

届时对美国国债的需求将跌至谷底,美国国债的投资者将陷入一片恐慌。长期来看,美国的利率和通胀率将出现上涨。进口成本会变得更贵,出口成本则变得比以往更低,但美国将因此受损,因为美国是个净进口国。举个例子,2020年6月美国服务贸易和货物贸易项下进口总额为2090亿美元,而出口额则为1580亿美元,贸易逆差为500亿美元左右。

Alsoin the longer term, a weak dollar will suffocate business, increase unemployment, and even cause an economic depression.

此外从长期来看,美元汇率贬值会阻碍企业经营,增加失业率甚至导致美国经济出现衰退。

Summing Up

结论

A dollar crash is the stuff that economic nightmares are made of. In July 2020, I hadtweetedthat the dollar index had broken a key support level, an event that suggested weakness ahead.

美元汇率大幅贬值是导致美国经济前景走向深渊的导火索。2020年7月,我在推特上提到美元指数已跌破关键的支持位,这意味着美元汇率将持续下跌。

Image Source:Twitter

As perGoldman Sachs, there are clear and realconcernsabout the dollar maintaining its global leadership as a reserve currency. After the Stimulus-2 Bill got lost in political bickering, the dollar value has dipped some more.

高盛公司在研报中对于美元是否能维持其在全球外汇储备中主导货币的作用存有明确和迫切的疑虑,在2.0版本的经济刺激法案在美国国会触礁以后,美元汇率又有所下跌。

Though the currency will continue to retain its dominance in the medium term,economists are unable to visualize any positive developments in the long run.

尽管从中期来看,美元将继续保有其主导作用,但长期来看经济学家无法为美元勾勒出任何美丽的画面。

While we can hope for our dollar to retain its dominance in the long term, we know what could cause its collapse and the consequences of a crash. The prudent thing to do is always discount the worst and hope for the best.

我们希望美元继续稳保超然的地位,我们知道导致美元地位崩塌的因素以及一旦美元汇率崩溃式下跌的后果都有哪些,稳妥的做法应该是做好最坏的准备,争取最好的结果。

版权及免责声明:凡本网所属版权作品,转载时须获得授权并注明来源“融道中国”,违者本网将保留追究其相关法律责任的权力。凡转载文章,不代表本网观点和立场。

延伸阅读

版权所有:融道中国